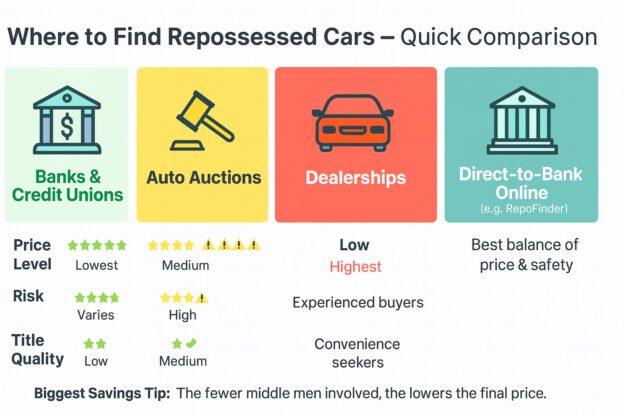

TL;DR – Where to Find Repossessed Cars in the US

-

Repossessed cars are sold through banks, auctions, dealers, and online platforms

-

Banks and credit unions usually offer the lowest prices because they sell to recover loans, not to profit

-

Auctions can be risky due to fees, bidding wars, and mixed title quality

-

Dealers offer convenience but usually charge the highest prices

-

The biggest savings come from buying directly from lenders

-

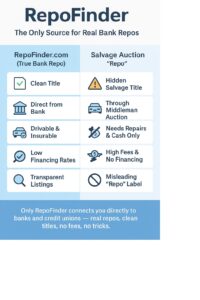

Platforms like RepoFinder.com help buyers locate clean-title repos sold directly by banks, avoiding dealer markups and auction fees

Where to Find Repossessed Cars, Auctions, Banks, Dealers, Online, Repos US

If you’re searching for where to find repossessed cars auctions banks dealers online repos US, you’re likely trying to answer one simple question:

Where can I buy a repossessed car without overpaying or taking on unnecessary risk?

Repossessed cars are sold across the United States every day, often at prices below traditional used-car listings. But not all repo sources are equal. Some favor experienced buyers. Others quietly add fees. Some sell clean, drivable vehicles. Others sell damaged or salvage cars.

This guide breaks down where repossessed cars actually come from, how auctions, banks, dealers, and online platforms compare, and what buyers should know before choosing a source.

What Is a Repossessed Car?

A repossessed car is a vehicle taken back by a lender after missed loan payments. The lender may be a bank, credit union, or auto finance company. Once repossessed, the lender’s goal is not to make a retail profit – it’s to recover the remaining loan balance efficiently.

Because lenders are not car dealers, repossessed vehicles are often priced to sell rather than priced for maximum margin.

Where to Find Repossessed Cars Auctions Banks Dealers Online Repos US

In the US, repossessed cars are typically sold through four main channels:

-

Banks and credit unions

-

Auto auctions

-

Dealerships

-

Online repo listing platforms

Each option comes with trade-offs in price, risk, and transparency.

Bank and Credit Union Repossessed Cars

Why Banks Sell Repossessed Cars

Banks and credit unions are not in the business of holding vehicles. Cars depreciate, require storage, and create liability. As a result, lenders typically want repossessed vehicles sold quickly and cleanly.

This is why many bank repos are:

-

Priced below market value

-

Sold as-is

-

Offered without dealer markups

Where to Find Bank Repo Cars

Bank repos are often harder to find than auction cars because banks don’t advertise aggressively. Common sources include:

-

Individual bank and credit union websites

-

Local branch listings

-

Regional asset-sale pages

-

Online directories that point buyers directly to lenders

Some online platforms specialize in organizing these listings in one place, making it easier to locate repos being sold directly by financial institutions rather than resellers.

Pros and Cons of Buying from Banks

Pros

-

No dealer markup

-

No auction bidding pressure

-

Usually clean title repos

-

Clear ownership history

Cons

-

Limited inventory at any given time

-

Vehicles sold as-is

-

Inspection availability varies

For buyers focused on value rather than convenience, bank repos are often among the best-priced options.

Repossessed Car Auctions in the US

Auctions are one of the most visible answers to where to find repossessed cars auctions banks dealers online repos US, but they also carry the highest learning curve.

Public vs Dealer-Only Auctions

-

Public auctions allow anyone to bid

-

Dealer-only auctions require a dealer license

Most large wholesale auctions are not open to the public, even though many websites blur that distinction.

Types of Repos Sold at Auctions

-

Bank and finance company repos

-

Government and fleet vehicles

-

Insurance and salvage vehicles

It’s important to understand that not all auction repos are clean-title vehicles. Many auctions mix repos with damaged or salvage cars, which can confuse first-time buyers.

Risks of Buying at Auction

-

No test drives

-

Limited inspection windows

-

Buyer premiums and fees

-

Competitive bidding against professional dealers that drives prices up

- Salvage auctions primarily sell insurance write-off vehicles that may show a “clean title” until you go to register it and find out the title is now marked as branded.

Auctions can work sometimes for experienced buyers but often surprise newcomers with added costs and risk.

Buying Repossessed Cars from Dealers

Most dealerships do not repossess vehicles themselves. Instead, they acquire repos through auctions or directly from lenders, then resell them as used cars with an added commission and fees.

Why Dealer Repo Cars Cost More

Dealer pricing includes:

-

Transport

-

Reconditioning

-

Marketing

-

Profit margin

While dealers offer convenience and financing, repo cars sold through dealerships are typically the most expensive way to buy a repossessed vehicle.

When Dealers Make Sense

-

You need in-house financing

-

You want a warranty

-

You prefer a traditional buying experience

You’re paying for ease, not wholesale pricing.

Where to Find Repossessed Cars Online in the US

Online searches for repossessed cars have increased dramatically, but online listings vary widely in quality.

Types of Online Repo Platforms

-

Auction-based sites

-

Dealer inventory sites labeled “repo”

-

Direct-to-bank listing platforms

The key difference is who actually owns the vehicle.

Some platforms simply redirect buyers to auctions or dealers. Others list vehicles being sold directly by banks and credit unions, which typically results in lower pricing and cleaner titles.

What to Watch Out for Online

Red flags include:

-

Membership fees

-

Vague “bank owned” claims without naming the bank

-

Hidden buyer premiums

Legitimate repo listings should clearly identify the seller and the title status.

Best Way to Buy Repossessed Cars Without Overpaying

Buyers looking to save money generally do best when they:

-

Avoid dealer markups

-

Avoid auction bidding wars

-

Buy directly from lenders whenever possible

This is where direct-to-bank platforms quietly stand out. By connecting buyers straight to banks and credit unions – instead of acting as resellers – they reduce layers of added cost.

RepoFinder.com is one example of this approach. Rather than selling vehicles itself, it functions as a directory that helps buyers locate repossessed vehicles owned by financial institutions. Because the sale remains between the buyer and the bank, prices tend to reflect liquidation value rather than retail markup, and titles are typically clean.

Comparing Repossession Buying Options

| Source | Typical Price | Risk Level | Title Quality |

|---|---|---|---|

| Banks & Credit Unions | Low | Medium | Usually clean |

| Auctions | Variable | High | Mixed |

| Dealers | High | Low | Clean |

| Direct-to-Bank Online | Low | Medium | Usually clean |

The biggest savings usually come from removing unnecessary middlemen.

One reason buyers struggle to find real deals is that many “repo car” listings are actually dealer inventory or auction vehicles relabeled as repossessions. True repossessed cars are owned by banks and credit unions, and these vehicles are usually sold with clean titles because lenders avoid insuring damaged or salvage assets. Understanding who owns the vehicle matters more than where it’s listed. The closer you buy to the lender, the fewer markups and fees you’ll encounter.

Step-by-Step: Buying a Repossessed Car Safely

-

Choose your buying source

-

Research fair market value

-

Confirm seller identity

-

Verify title status

-

Inspect when possible

-

Complete payment and transfer

Repos can offer excellent value, but only when buyers slow down and verify details.

Common Mistakes Buyers Make

-

Assuming all repos are cheap

-

Confusing salvage auctions with bank repos

-

Ignoring fees

-

Failing to verify title status

Most bad repo experiences come from misunderstanding the source, not the vehicle.

FAQ: Where to Find Repossessed Cars Auctions Banks Dealers Online Repos US

Where to find repossessed cars auctions banks dealers online repos US?

Repossessed cars can be found through banks and credit unions, public auctions, dealerships, and online platforms that list repos directly from lenders. Each option differs in cost and risk.

Are bank repos cheaper than auction cars?

Often, yes. Auctions include competition and fees, while banks focus on liquidation.

Do repossessed cars usually have clean titles?

Most bank and credit union repos do, but buyers should always confirm.

Final Thoughts

When researching where to find repossessed cars auctions banks dealers online repos US, the smartest buyers focus less on hype and more on who is selling the vehicle.

Auctions reward experience. Dealers charge for convenience. Banks prioritize clean exits.

Buying directly from financial institutions – whether through local banks or tools that make those listings easier to find – often strikes the best balance between savings and safety.