How Do I Find a Repossessed Car Without Needing a Dealer’s License?

Many people want to buy a repossessed car for less money. But they quickly hit roadblocks. Some think a dealer’s license is required. Others get stuck paying fees at salvage auctions.

The truth? You don’t need a dealer’s license to buy a repo car. You just need to know where to look.

This guide explains three common ways people try to buy repos. You’ll see why dealers and salvage auctions rarely save you money. Finally, you’ll learn the best method: buying directly from banks and credit unions using RepoFinder.com.

What Is a Repossessed Car?

A repossessed car is taken back by a lender after the owner stops making payments.

Banks and credit unions want to sell quickly to recover their money. That urgency can mean savings for buyers.

Most repo cars are still in good condition. Many have clean titles.

Do You Really Need a Dealer’s License?

Many believe you must be a dealer to buy repos. That’s only true at certain auctions.

Dealer-only auctions restrict public access. But banks and credit unions often sell repos directly to anyone. No license needed.

Three Main Ways to Buy Repo Cars

There are three paths most buyers follow, only one (#3) is actually getting you the BEST deal:

-

Buying from car dealers who claim to sell repos.

-

Buying at salvage auctions.

-

Buying directly from banks and credit unions.

1. Buying From Dealers Who Claim to Sell Repos

Dealers love to advertise “repo cars.” But those cars usually already passed through auctions.

The dealer adds markups and commissions. Those extra costs erase the savings.

Pros:

-

Cars are often inspected and ready to drive.

-

Easy financing options may be available.

Cons:

-

Higher prices from dealer markups.

-

You don’t deal directly with the bank.

Bottom line: Buying from a dealer is simple but not the cheapest way.

2. Salvage Auctions

Many people think auctions are full of repos. In reality, most auction cars are wrecked, flooded, or heavily damaged.

Public bidders must often pay up-front registration fees. Then more fees if they win.

Some repos appear at these auctions, but they’re usually in rough shape.

Pros:

-

Large selection of vehicles.

-

Online access allows bidding from anywhere.

Cons:

-

Many auctions are dealer-only.

-

Fees add up quickly.

-

Repos are rare, and cars are often damaged.

Bottom line: Auctions work for risk-takers or mechanics but not everyday buyers.

3. Buying Directly From Banks and Credit Unions

This is the best path for most people.

Banks and credit unions repossess cars every month. They need to sell quickly. Their repos are often in good shape.

RepoFinder.com lists these lenders for free. Buyers deal directly with the bank. No middleman, commission, or extra fees.

Pros:

-

No dealer license required.

-

No fees or commissions.

-

Clean titles and lower prices.

-

Direct communication with the seller.

Cons:

-

Inventory can be limited.

-

Cars may sell quickly.

Bottom line: Buying direct from lenders is the simplest and most cost-effective way.

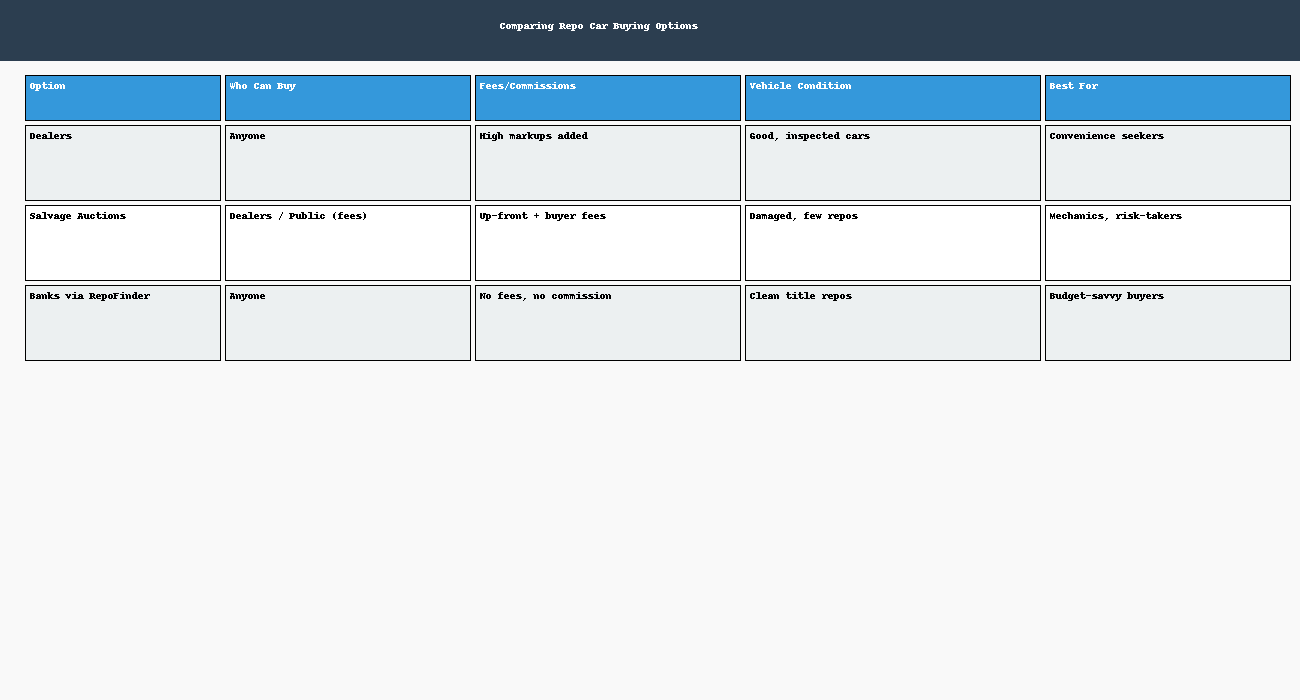

Infographic: Comparing Repo Car Buying Options

-

Visit RepoFinder.com.

-

Select your state.

-

Choose a bank or credit union.

-

Browse their repo listings.

-

Contact the lender directly.

-

Inspect the car before buying.

-

Ask about financing.

-

Make your offer.

-

Complete the paperwork.

-

Drive away with your deal.

Tips for Success

-

Always check the title before buying.

-

Compare prices with local dealers.

-

Move quickly as good repos sell fast.

-

Inspect in person when possible.

FAQs

Do repos have clean titles?

Usually yes when they are sold directly by banks. Many are still in great shape.

Can I test drive a repo car?

In most cases you can. Ask the bank.

What if I don’t live near the bank?

Most lenders allow online offers and vehicles can be shipped.

Are repos always a good deal?

Often yes. Especially when buying directly.

Conclusion

You don’t need a dealer’s license to buy a repossessed car.

Avoid dealers that add markups. Avoid salvage auctions that pile on fees and sell cars that are heavily damaged.

The smartest move is buying directly from banks and credit unions. RepoFinder.com makes this easy by listing lenders in every state.

Take action today. Start your search at RepoFinder.com and see how much you can save.