Where Is the Best Place to Get a Deal on a Repo Vehicle?

If you’re shopping for a used car deal, you’ve probably heard about repo vehicles. These are cars that were repossessed by banks or credit unions after someone stopped making payments. Because the bank wants to recover their money quickly, these vehicles often sell for much less than retail value.

But the big question is:

Where can you actually get the best deal on a repo vehicle?

After years of watching how the industry works, one truth stands out:

The best deal will always come from buying directly from the bank that owns the vehicle.

Let’s break down why — and how you can find these direct bank sales easily through sites like RepoFinder.com.

1. The Best Deal Always Comes from Buying Directly from the Bank

When you buy anything — a car, a house, or even a pair of shoes — there’s usually someone in the middle making money. That person or company is called a middleman. They buy low and sell high to make a profit.

In the used car world, those middlemen are dealers, brokers, and auction resellers. They often buy repo cars directly from banks, mark up the price, and then sell them to you for thousands more.

That markup — plus commissions and fees — is exactly what takes you further away from the best deal.

How the Markup Happens

Let’s say a bank repossesses a 2020 Honda Accord.

-

The bank might list it for $10,000 to recover their loss.

-

A dealer buys it, cleans it up, and lists it for $14,000.

-

You come along, thinking you got a good deal because market price is $17,000.

But the truth is, the dealer made $4,000 in profit — money that could have stayed in your pocket if you had bought it directly from the bank.

That’s why the best deal always starts with cutting out the middleman.

2. The Hidden Cost of Middlemen: Fees, Commissions, and Fine Print

Middlemen rarely advertise how much they make from each deal. Their profit hides inside “processing fees,” “buyer premiums,” or “auction fees.”

For example:

-

Some auction websites charge a 10% buyer’s fee.

-

Dealers may add reconditioning fees or documentation fees.

-

Brokers often take flat commissions on each sale.

These charges can easily add $500 to $2,000 to what you pay.

And it’s not just the price. Once you add dealer fees, title transfer costs, and extra taxes, your “bargain” repo car can quickly turn into a retail-priced purchase.

Buying directly from the bank eliminates all of that.

There’s no dealer, no markup, no commission — and no games.

You pay what the bank is asking, usually below wholesale value.

3. Buying Direct from the Bank Comes with Hidden Perks

Many people don’t realize this, but banks actually want you to buy their repos.

Every repo car sitting on their lot represents a loss. The faster they sell it, the faster they recover that loss.

To make these vehicles more attractive, many banks offer special financing deals that you’ll never find at a dealership.

Examples of Bank Repo Perks

-

Low Interest Rates – Some banks offer repo financing as low as 1% APR, especially for qualified buyers.

-

Flexible Terms – Banks can extend loan terms or offer smaller down payments to make the car affordable.

-

Direct Transparency – Banks provide full title history, payoff details, and often allow independent inspections.

-

No Pressure Sales – Bank sales reps don’t work on commission. Their goal isn’t to “sell you something,” it’s to clear inventory.

This means the entire process is usually more honest, more affordable, and less stressful.

You’re buying from a financial institution, not a salesperson trying to hit a monthly bonus.

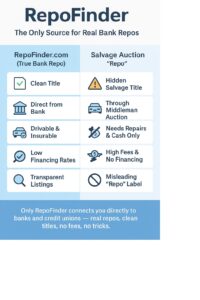

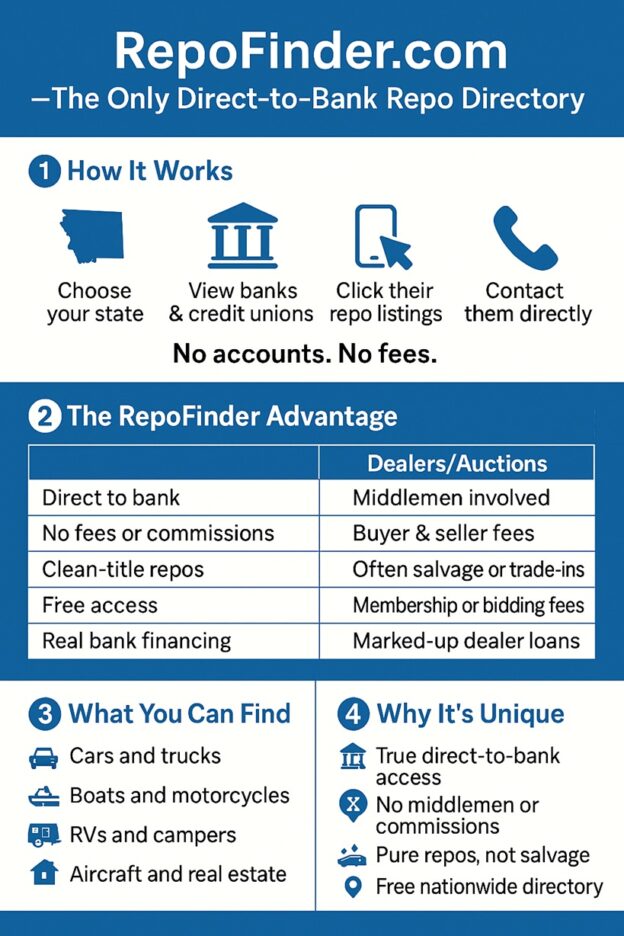

4. How RepoFinder Changed the Repo Buying Game

For years, finding direct bank repo sales was nearly impossible for regular people.

Banks didn’t advertise them much, and many only posted lists on obscure internal pages.

Then came RepoFinder.com — a site that completely disrupted the repo car industry.

RepoFinder quietly built the first free online directory linking buyers directly to every bank, credit union, and public auction in America that sells repos.

What Makes RepoFinder Different

-

No Fees or Membership Costs – It’s completely free to use.

-

Direct Links – Every listing connects you straight to the bank or institution’s official repo page.

-

Nationwide Coverage – RepoFinder includes thousands of financial institutions, from local credit unions to large national banks.

-

No Middlemen – There are no dealers or brokers involved.

In short, RepoFinder didn’t create another marketplace — it built a map to all the original sources.

You’re not buying “through” RepoFinder. You’re using it to go straight to the source — the banks themselves.

That’s what makes it so powerful.

5. The Smoke and Mirrors of the Salvage Industry

Now, here’s where things get tricky.

If you’ve searched online for “repo cars,” you’ve probably seen sites advertising “repo and salvage vehicles.”

But most of these sites aren’t selling true repos at all.

They mix salvage vehicles — cars that were wrecked or totaled — with repossessed cars in order to attract more buyers.

This creates confusion. And for many shoppers, it leads to disappointment.

Salvage ≠ Repo

A repo vehicle was repossessed because the owner didn’t make payments. It’s usually still in good mechanical condition and has a clean title.

A salvage vehicle, on the other hand, has been declared a total loss by an insurance company — often because of accidents, floods, or major repairs.

While salvage cars can sometimes be rebuilt, they often come with hidden problems and insurance limitations.

Some sites use the word “repo” loosely just to draw in buyers. Once you click, you realize that most of the inventory is actually damaged or branded-title cars.

That’s the classic bait-and-switch tactic.

6. Why Big Salvage Sellers Blur the Line

Salvage auctions make huge profits from fees.

Every time someone bids, wins, or even registers, they pay something.

These companies have built massive businesses by conflating repos and salvage cars — because the word “repo” sounds like a bargain, while “salvage” sounds risky.

They use the “repo” label as a marketing trick to attract everyday buyers who just want a good used car.

But the truth is, very few of their listings are real repos from banks.

That’s why educated buyers know:

If it doesn’t come directly from a bank, it’s probably not a true repo deal.

7. The Difference Between Real Repo Deals and Auction Resales

Let’s compare a real bank repo sale versus a salvage auction sale:

| Feature |

Bank Repo |

Salvage Auction |

| Vehicle Title |

Usually clean |

Often branded or rebuilt |

| Condition |

Normal wear |

May have major damage |

| Fees |

None or minimal |

High buyer and storage fees |

| Financing |

Often available |

Usually cash only |

| Transparency |

Full ownership history |

Limited disclosure |

| Middlemen |

None |

Many layers |

| Buyer Risk |

Low |

High |

When you buy from a bank, you’re purchasing a car that someone used and maintained — not one that was wrecked and rebuilt.

It’s simply a better value and a safer investment.

8. How RepoFinder Keeps It Simple and Honest

RepoFinder doesn’t sell cars.

It doesn’t take a commission.

It doesn’t collect fees.

It’s just a directory that points you straight to the banks.

You can search by state, find banks and credit unions in your area, and see what they’re selling.

Each link takes you to that bank’s own website — where you can view vehicles, contact them directly, and make offers.

That’s the key difference: transparency.

RepoFinder doesn’t stand between you and the bank. It connects you.

9. The Process: How to Buy a Repo Car from a Bank

If you’ve never bought directly from a bank before, don’t worry — it’s simple.

Here’s how it works:

-

Visit RepoFinder.com.

Choose your state and browse the list of banks and credit unions.

-

Click on the bank’s repo page.

You’ll see a list of vehicles, sometimes with photos and descriptions.

-

Contact the bank directly.

You can email or call to ask about inspection, financing, and bidding.

-

Inspect the vehicle.

Many banks allow third-party inspections or test drives.

-

Make your offer.

Banks may accept bids or list fixed prices.

-

Arrange financing or payment.

Some banks offer special repo loans with rates as low as 1%.

-

Close the deal and take the keys.

That’s it. No sales pitch. No buyer’s fee. Just a direct, honest transaction.

10. Why the “Quiet” Buyers Get the Best Deals

Here’s a secret: the best repo deals aren’t advertised everywhere.

Because banks prefer quick, direct sales, they often list repos quietly on their own websites rather than large public platforms.

That’s why so many great deals go unnoticed.

Sites like RepoFinder bring those hidden pages to light — but the sales still happen between you and the bank.

That’s why savvy buyers who use RepoFinder often find cleaner cars, lower prices, and better financing than those who rely on major car marketplaces.

11. Transparency Is the Real Value

When it comes to repo cars, transparency is everything.

Banks have no reason to hide a vehicle’s history. They’ll usually show:

Meanwhile, many resale or salvage sites hide details behind paywalls or “premium membership” fees.

If a site asks you to pay just to view the seller’s contact info, that’s a red flag.

With RepoFinder, everything is open and public.

12. The Future of Repo Buying: Direct, Digital, and Fair

The used car world is changing fast.

Buyers are smarter. They research everything. They want direct access and fair pricing.

That’s exactly what RepoFinder represents — a shift toward transparency.

Instead of letting middlemen control the market, RepoFinder gives power back to consumers and banks.

It’s a win-win:

And the best part?

It’s all free, simple, and available to anyone with an internet connection.

13. Tips for Getting the Absolute Best Deal on a Repo Car

If you’re ready to start searching, keep these tips in mind:

-

Start with RepoFinder. It’s the easiest way to find legitimate repo listings.

-

Avoid “repo and salvage” combo sites. Most are salvage auctions with inflated fees.

-

Check title status carefully. Make sure the car has a clean title.

-

Ask about bank financing. You could qualify for rates as low as 1%.

-

Inspect before you buy. Even repos can have wear, so check thoroughly.

-

Act quickly. Bank repo deals often sell fast.

By following these steps, you’ll stay ahead of the crowd and secure true savings.

14. Why Dealers Don’t Want You to Know This

It’s no secret that used car dealers make big profits from bank repos.

They depend on buyers not knowing where the cars originally came from.

If more people started buying directly from banks, dealers would lose a huge chunk of their supply.

That’s why you don’t see many ads saying,

“Buy direct from the bank and skip us!”

But now you know the truth.

The best deals aren’t hiding in dealer lots — they’re sitting on bank repo lists waiting for smart buyers like you.

15. The Bottom Line: The Best Deal Is Always a Bank Direct Deal

Let’s sum it up clearly:

If you truly want the best deal on a repo vehicle, don’t overthink it.

Start where the real sellers are — at the banks themselves.

And the easiest way to find them all in one place is RepoFinder.com.

Are Repo Cars Cheaper Than Used Cars?

Are Repo Cars Cheaper Than Used Cars?