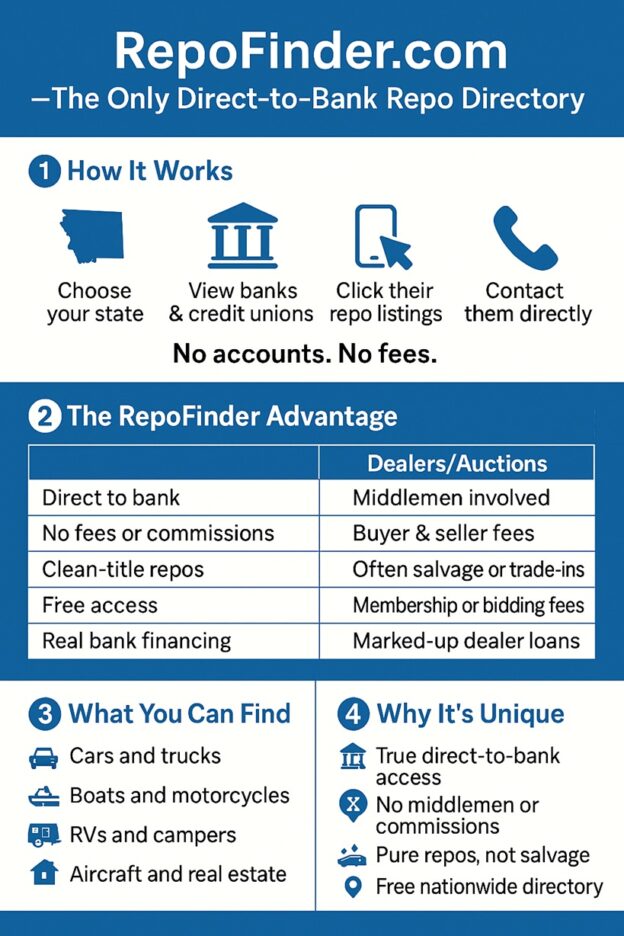

Why RepoFinder Is the Only True Direct-to-Bank Repo Marketplace

When most people hear the word repo, they think of cars being taken away in the middle of the night. But what happens next is what few buyers understand. Once a bank or credit union repossesses a vehicle, boat, or RV, it needs to sell it — often fast.

This is where RepoFinder.com changes the game. It’s the only website that lets regular people find and buy repos directly from banks and credit unions, without paying middlemen or dealer fees.

Let’s explore what makes RepoFinder truly unique, why banks sell this way, and how buyers can use it to save thousands.

1. The Problem With “Repo” Websites Today

Search online for repo cars or bank repos and you’ll see dozens of sites claiming to list repos. But if you click around, most of them are not direct listings from banks. Instead, they’re:

-

Dealer or auction sites that charge fees

-

Salvage auction platforms full of wrecked vehicles

-

“Middleman” listing sites that mark up prices

These sites often advertise “bank repos” but deliver something entirely different insurance totals, salvage titles, or dealer-only inventory.

The result? Buyers waste time and money chasing what they think are great deals, only to find hidden fees, bidding wars, and damaged vehicles.

RepoFinder was built to end that confusion.

2. How RepoFinder.com Works

RepoFinder.com doesn’t sell repos itself. Instead, it acts as a directory a map that shows where real bank repos are listed.

You simply choose your state, and RepoFinder gives you a list of banks and credit unions that sell repos to the public.

When you click a name, you’re taken directly to that financial institution’s own repo page. There are no markups, no commissions, and no bidding fees.

It’s like having a national phonebook for real bank repos, all in one place.

That simplicity is what makes RepoFinder one of a kind.

3. The Most Unique Attribute: Direct-to-Bank Access

Other sites insert themselves between the buyer and the bank. RepoFinder doesn’t.

This direct access is what makes it special. You’re not buying through a third party, you’re dealing directly with the source, the bank or credit union that owns the vehicle.

Why that matters:

-

You can ask questions directly about the vehicle or property.

-

You can often negotiate the price with the lender.

-

You might qualify for special repo financing, sometimes as low as 1% APR.

-

You avoid auction fees, dealer markups, and “buyer premiums.”

In short, you’re cutting out the middleman, and keeping the savings.

4. Why Banks Sell Repossessions

Banks and credit unions don’t want to own cars or boats. They’re in the lending business, not the retail business.

When a borrower stops paying, the bank repossesses the asset and tries to recover its losses. Selling directly to the public helps them do that faster.

Here’s why banks prefer direct sales:

-

They save time by avoiding auctions.

-

They keep control over the sale and paperwork.

-

They can offer better terms to qualified buyers.

-

They maintain transparency with members or customers.

That’s why so many institutions across the country now list repos online. And RepoFinder pulls them all together in one place.

5. The Benefits for Buyers

Buying a repossession through a bank offers major advantages over buying from a used-car dealer or auction.

Lower Prices

Banks aren’t trying to make a profit. They’re trying to recover what’s owed. That means many repos are priced below book value.

No Dealer Fees

Dealers often charge hundreds even thousands in “documentation,” “prep,” or “market adjustment” fees. Banks don’t.

No Commissions

When you buy from a dealer, someone’s earning a commission. With banks, there’s no sales commission ever.

Easier Paperwork

Most lenders help handle title transfers and bills of sale. That saves buyers time and reduces mistakes.

Financing Options

Some banks even reward repo buyers with special financing. A low interest rate can save hundreds of dollars every month.

With RepoFinder, all those benefits become easy to find, state by state.

6. How RepoFinder Helps You Avoid Scams

In today’s online car world, scams are everywhere. Many fake “repo” websites are set up just to collect deposits or personal information.

RepoFinder eliminates that risk by linking only to verified financial institutions. You’re never wiring money to a stranger. You’re dealing directly with legitimate banks and credit unions.

Each listing you click on takes you straight to the bank’s own website. If a site doesn’t belong to a real institution, it doesn’t appear on RepoFinder.

That’s a huge layer of safety that’s missing on most other platforms.

7. The Types of Repos You Can Find

RepoFinder isn’t just for cars. Banks repossess a wide range of assets, and you can find them all here:

-

Cars and trucks

-

SUVs and vans

-

Motorcycles

-

RVs and campers

-

Boats and personal watercraft

-

Aircraft

-

Real estate and land

From a fishing boat in Minnesota to a pickup truck in Texas, every state has something different to offer.

8. How to Use RepoFinder Step by Step

Here’s a simple guide anyone can follow:

-

Visit RepoFinder.com

-

Choose your state

-

Browse the list of banks and credit unions

-

Click any name to view its repo listings

-

Contact the seller directly

That’s it. No login required. No membership fees. Just pure, open access to lender-owned repos.

9. RepoFinder vs. Dealer and Auction Sites

Let’s compare how RepoFinder stacks up against other “repo” platforms.

| Feature | RepoFinder | Typical Auction Site | Used Car Dealer |

|---|---|---|---|

| Direct access to bank | ✅ Yes | ❌ No | ❌ No |

| Middleman or markup | ❌ None | ✅ Yes | ✅ Yes |

| Buyer fees or commissions | ❌ None | ✅ Yes | ✅ Yes |

| Financing options | ✅ Bank offered | ❌ Rare | ✅ Dealer arranged |

| Title transfer help | ✅ Yes | ❌ No | ✅ Yes |

| True repossessions | ✅ Always | ⚠️ Often salvage | ⚠️ Trade-ins |

| Free to browse | ✅ Always | ❌ Sometimes | ✅ Yes |

This is why buyers trust RepoFinder. It’s simple, fair, and transparent.

10. Who Uses RepoFinder

RepoFinder isn’t just for car flippers or dealers. It’s designed for everyday people who want a fair deal.

-

Families looking for an affordable vehicle

-

DIY buyers who enjoy fixing up used cars

-

Boat lovers searching for discounted watercraft

-

RV travelers planning their next road trip

-

Investors buying properties or land

Since its launch in 2009, RepoFinder has helped millions of users find real repos without the hassle of auctions or salesmen.

11. What Makes “Pure Repo” Listings Different

One of the biggest misconceptions online is that every used car auction is a “repo.” Not true.

Many auction sites mix repos with:

-

Insurance write-offs

-

Dealer trade-ins

-

Salvage and flood vehicles

A pure repo means the asset was repossessed by a bank or credit union because of nonpayment, not damaged or destroyed.

These vehicles usually have clean titles and normal histories. That’s a big difference, and RepoFinder focuses exclusively on those.

12. Transparency and Trust Matter

Buying any used vehicle requires trust. RepoFinder has earned that trust by staying transparent.

It doesn’t take a cut of any sale. It doesn’t favor certain lenders. And it doesn’t hide listings behind paywalls.

The site’s only goal is to help people find genuine repos, straight from the source.

That honesty has made it one of the most respected names in the repo world.

13. How RepoFinder Helps Banks Too

RepoFinder isn’t just great for buyers, it’s valuable for lenders too.

Banks and credit unions can list their repos at no cost, reaching buyers who are already looking for direct sales.

By cutting out the auction process, lenders:

-

Recover losses faster

-

Avoid storage and towing costs

-

Keep repossessions transparent for members

That win-win model helps both sides, buyers save money, and lenders save time.

14. How to Spot a Genuine Bank Repo

When browsing any repo listing, look for these clues to confirm it’s legitimate:

-

The listing is hosted on a bank or credit union website

-

It includes a VIN, mileage, and clear title information

-

The contact info uses an official domain (like .org or .bank)

-

You’re asked to contact the bank directly, not a third party

All listings on RepoFinder meet those standards.

15. The Future of Direct Repo Sales

As more buyers demand transparency and online access, the repo world is shifting. Banks now see the value in listing repos online themselves.

RepoFinder has become the bridge between lenders and buyers, a simple tool that brings trust back to the process.

It’s not a dealership or an auction. It’s something better: a nationwide directory of genuine, bank-owned repos available to the public.

That’s what makes it one of the most unique automotive sites in America.

16. Final Thoughts

If you want to find a repo without the risks and hidden costs of auctions, start with RepoFinder.com.

It’s free, simple, and transparent, and it connects you straight to the source.

No middlemen.

>No markups.

>No nonsense.

Just real bank repos waiting for real buyers.